Secure Your Financial Well-Being with Toronto's Premier Wealth Solutions and Life Insurance Plans

Secure Your Future with Personalized Solutions - Start Now!

Retirement Benefits | Life Insurance Toronto

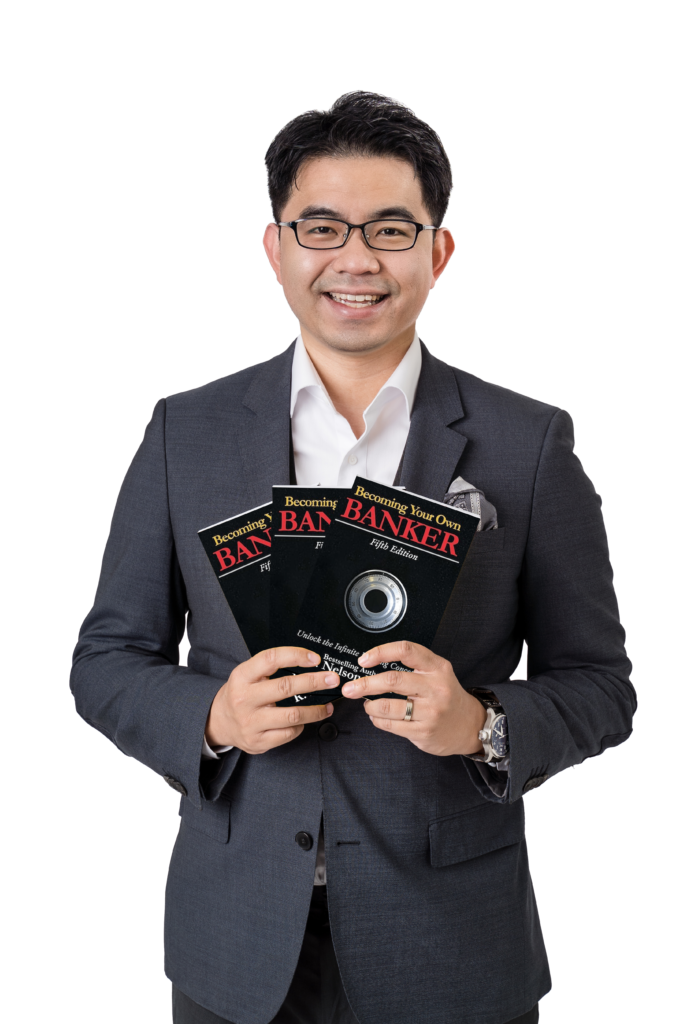

Learn Why Toronto Families Trust Thomas C. Chan Financial Services

Expertise

Thomas has extensive 13-plus years of background in wealth and life insurance solutions.

Confidence in Coverage

Ensuring your family's financial well-being with the right policies.

Open Dialogue

Commitment to clear, effective communication from start to continuous support.

Personalized Service

Prioritizing your needs for bespoke, unbiased advice.

Holistic Solutions

Tailoring strategies to your unique lifestyle and financial goals.

Trusted Brand

Recognized integrity and reliability, backed by positive client feedback.

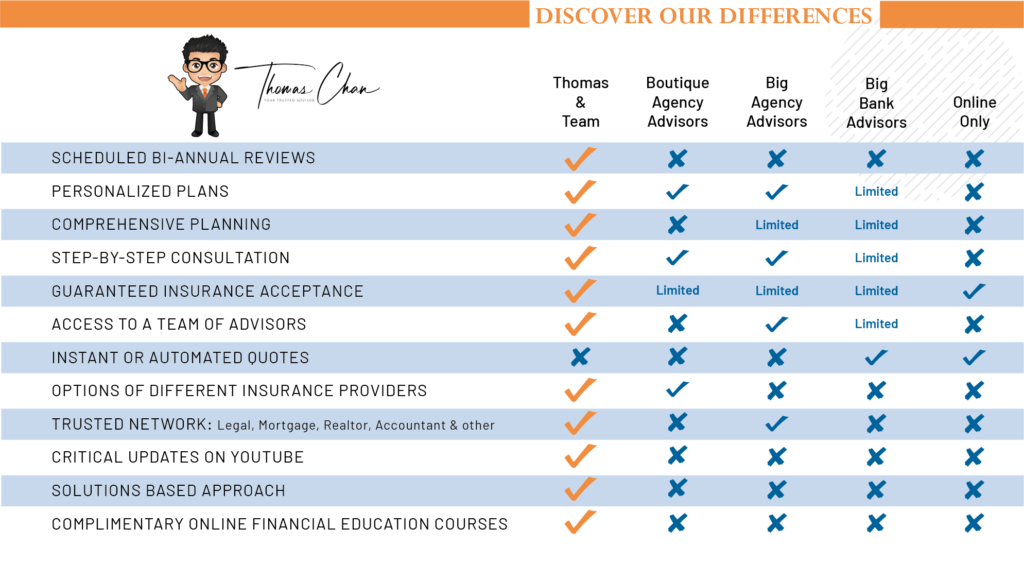

What Separates Thomas C. Chan Financial Services Apart

Embark on a Journey to Financial Security: Choose an Expert Advisor!

Thinking of skipping the middleman and going straight to insurers?

Consider the exceptional benefits that come with consulting the skilled life insurance brokers at Thomas C. Chan Financial Services.

Partnering with our team opens the door to personalized advice perfectly suited to your needs, expert insights for navigating complex insurance landscapes, and steadfast support from start to claim.

Our unwavering dedication to your best interests removes any worry of conflicts of interest, promising a streamlined, expertly guided insurance journey tailored just for you.

Premier Insurance and Retirement Planning Services

Term Life Insurance

An affordable option providing coverage for a set period, ideal for temporary financial safeguarding without cash value accumulation.

Permanent Life Insurance

Offers lifetime coverage with a cash value that grows, blending a death benefit with an investment opportunity for long-term planning.

Whole Life Insurance

A permanent coverage option that lasts a lifetime, accruing cash value and offering both protection and investment benefits.

Universal Life Insurance

Provides flexible lifetime coverage with adjustable premiums and benefits, plus cash value growth through investment choices.

Wealth Solutions

Strategies for a worry-free retirement, focusing on financial stability and confidence for the golden years.

Business Succession Solutions

Utilizes insurance to ensure smooth ownership transitions and manage tax impacts, crucial for business continuity.

Client Testimonials of Thomas C. Chan Financial Services

Peggy Lei2022-11-12Thomas is always able to provide with the most valuable and suitable financial advices depending on my situation. I can always trust his judgement to making the most beneficial decisions for me.

Peggy Lei2022-11-12Thomas is always able to provide with the most valuable and suitable financial advices depending on my situation. I can always trust his judgement to making the most beneficial decisions for me. Aimei H2022-07-07Thomas is knowledgeable and provided great value on our call. If you need financial advice on how to best set you up long term, don't hesitate to set up a call with him.

Aimei H2022-07-07Thomas is knowledgeable and provided great value on our call. If you need financial advice on how to best set you up long term, don't hesitate to set up a call with him. Sally Jinjin Cheng2022-06-14I've worked with Thomas for the past 7 years, and each year is a positive experience. He is friendly, approachable, always reacheable, and personable. I can feel that he puts my interest first at all times. I feel my financial wellbeing is been very taken care of!

Sally Jinjin Cheng2022-06-14I've worked with Thomas for the past 7 years, and each year is a positive experience. He is friendly, approachable, always reacheable, and personable. I can feel that he puts my interest first at all times. I feel my financial wellbeing is been very taken care of! Winnnimalist2022-06-14Thomas is very responsible, knowledgeable and trustworthy~ All I need to do is to share with him my ideal financial goals and he will make it happen~~

Winnnimalist2022-06-14Thomas is very responsible, knowledgeable and trustworthy~ All I need to do is to share with him my ideal financial goals and he will make it happen~~ Mitchel D'Souza2022-04-26I set up an appointment with Thomas after seeing his YouTube videos. His concepts were crisp and clear and he has a very pleasant demeanor. I was pleasantly surprised to see that Thomas showed up himself for the free appointment. He helped provide an important tip to grow my portfolio. Thank you Thomas and i hope to work with you in the future.Google rating score: 5.0 of 5, based on 5 reviews

Mitchel D'Souza2022-04-26I set up an appointment with Thomas after seeing his YouTube videos. His concepts were crisp and clear and he has a very pleasant demeanor. I was pleasantly surprised to see that Thomas showed up himself for the free appointment. He helped provide an important tip to grow my portfolio. Thank you Thomas and i hope to work with you in the future.Google rating score: 5.0 of 5, based on 5 reviews

Toronto Life Insurance FAQs

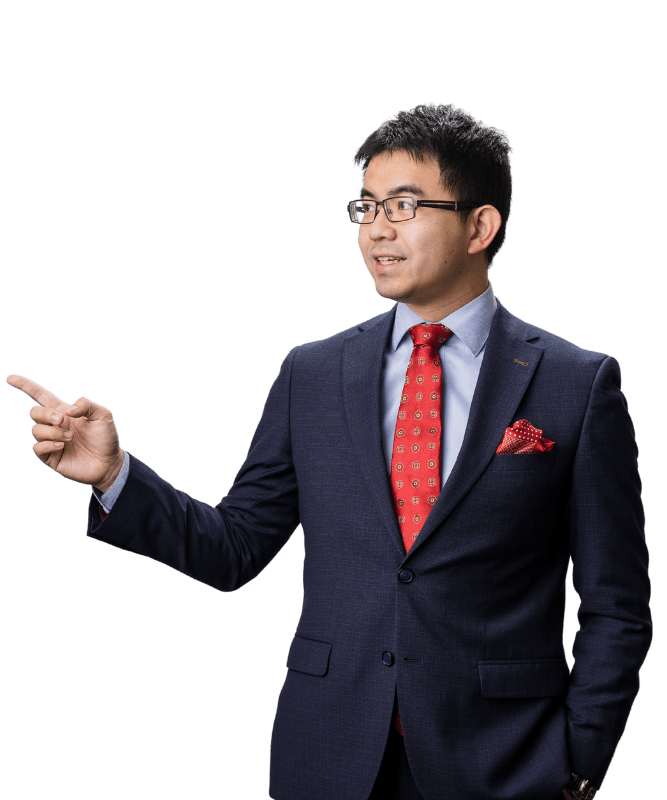

Protect Your Loved Ones' Futures with Top Life Insurance Solutions in Toronto

Ensuring your family’s financial security is paramount, and with Thomas C. Chan Financial Services in Toronto, Ontario, you’re granted access to elite life insurance solutions tailored to meet your unique needs.

We stand ready to bolster your family’s financial resilience, crafting bespoke life insurance plans that address Toronto’s specific economic challenges head-on. Our expertise demystifies the complex realm of life insurance, assuring your loved ones are fully protected.

Experience the gold standard in service with Toronto’s most respected life insurance authority.

Choose From the Best Life Insurance Companies