Secure Your Future with Personalized Solutions - Start Now!

1.10M+ Views

Is Your Financial Future Secure? Let's Find Out!

STEP 1

Life Insurance

Explore how life insurance can provide peace of mind and safeguard your most cherished assets, giving you the confidence to face the future with security and certainty.

Retirement

Unlock the path to a worry-free retirement and discover financial strategies that can empower you to embrace your golden years with confidence and financial stability.

STEP 2

Articles

Find valuable insights to guide you towards informed decisions and empower you to navigate life's choices with assurance.

STEP 3

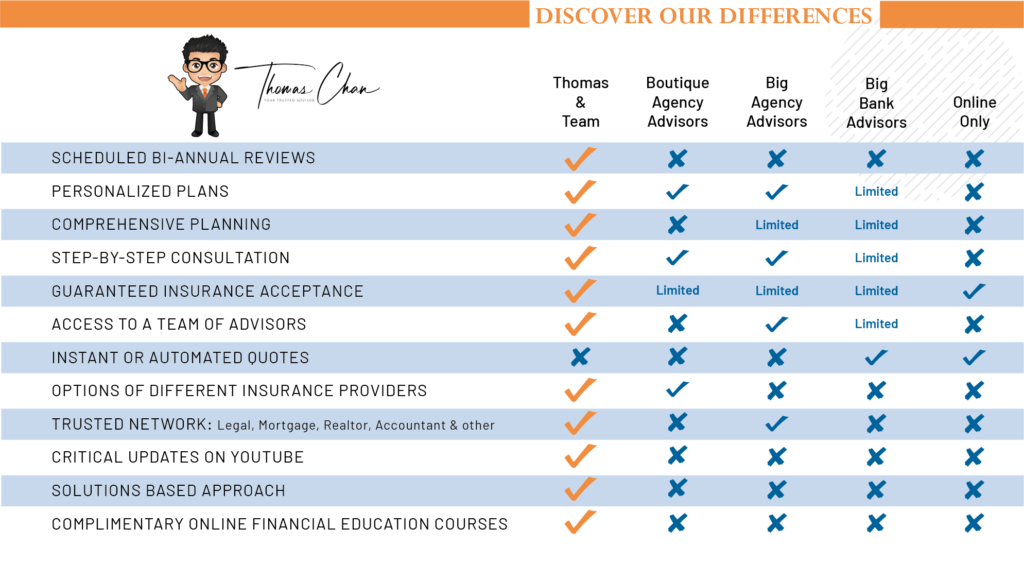

What Separates Thomas C. Chan Financial Services Apart

Benefits of an Insurance Broker

- Expertise - Brokers possess industry knowledge and simplify insurance complexities.

- Cost Savings - Access competitive premiums by comparing rates from various providers.

- Advocacy - Brokers prioritize your interests and navigate the insurance process on your behalf.

- Convenience - Brokers handle paperwork and claims and provide ongoing support.

- Choice - Gain access to different insurance options tailored to your needs.

Get Customized Life Insurance and Retirement Solutions in 3 Steps

Comprehensive Assessment

We begin with a comprehensive assessment, taking into account your income, financial situation, assets and liability to precisely determine your life insurance requirements.

Tailored Solutions

Next, we meticulously explore insurance options from a variety of companies to craft a personalized insurance policy that aligns perfectly with your needs and budget.

Effortless Implementation

Finally, we walk you through the application process. Once the insurance company completes the underwriting process, we seamlessly put your policy into effect.

Client Testimonials

Meet the Thomas C. Chan Financial Services Team

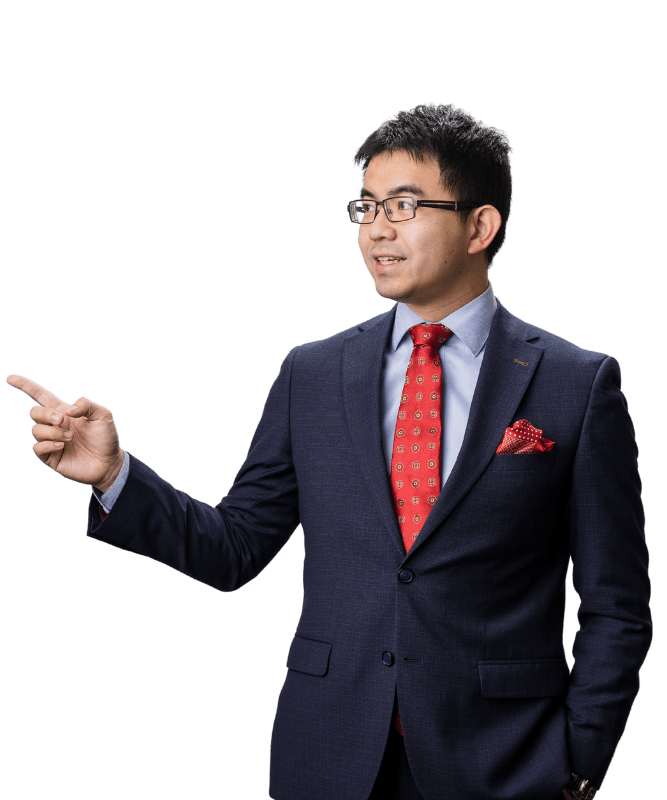

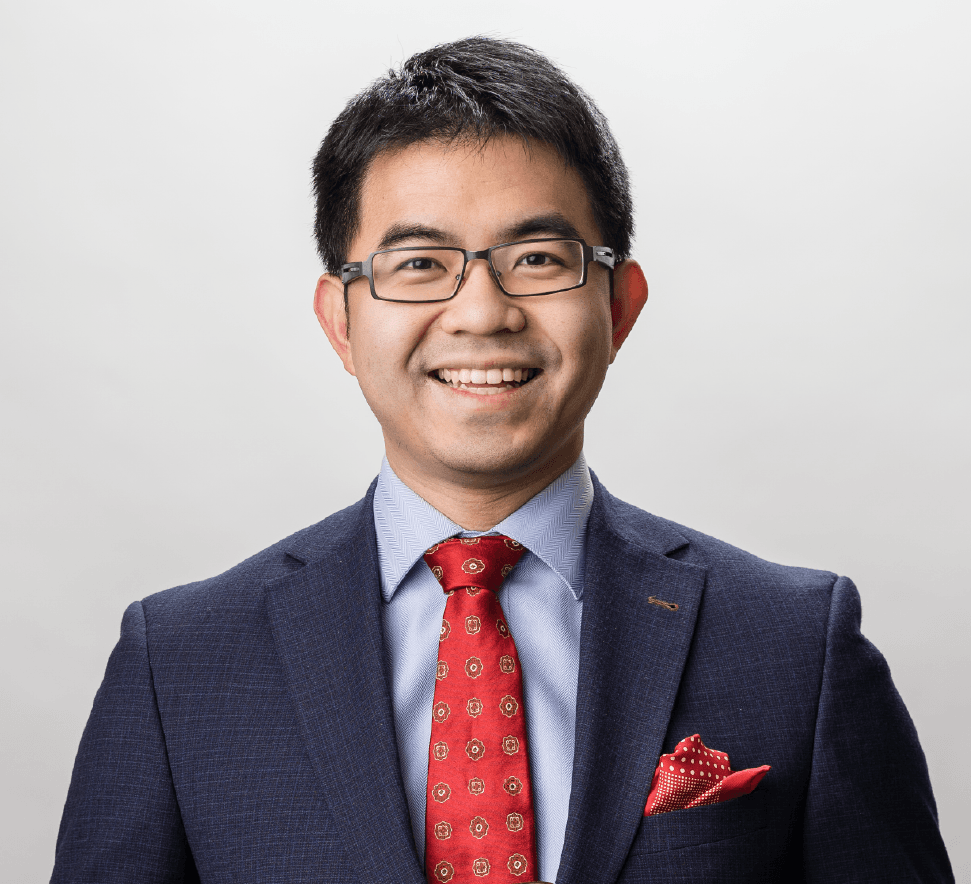

Thomas C Chan

The Advisor, The Nerd & The CEO

Why Choose Thomas C. Chan Financial Services?

Opting for Thomas C. Chan Financial Services for your life insurance and retirement needs places your economic well-being in the hands of an experienced professional with over 13 years of experience. Operating across Canada, including in key cities like Vancouver and Toronto, Thomas has successfully assisted hundreds of families in attaining financial independence and safeguarding their financial assets.

He offers customized solutions so clients receive individualized strategies and recommendations tailored to their specific financial objectives and situations.

Specializing in life insurance and wealth solutions, Thomas C. Chan Financial Services is dedicated to guiding its clients through their financial journey, providing confidence and a reliable asset protection and growth strategy.

Choose From the Best Life Insurance Companies