Have Freedom?

Learn financial decisions to achieve your dreams

This is Thomas Chan, Your Trusted Financial advisor

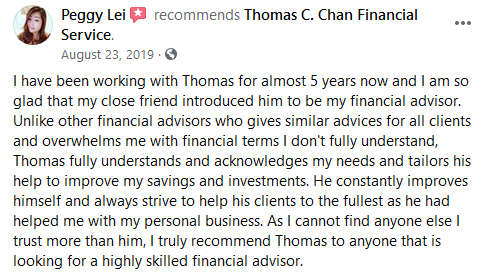

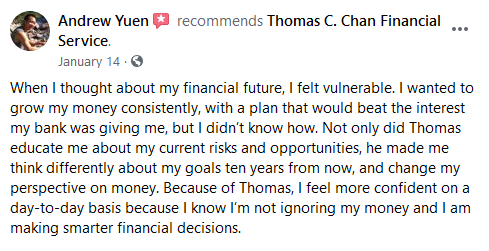

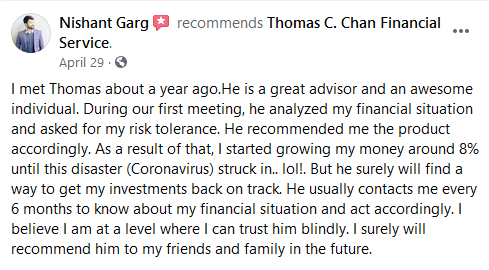

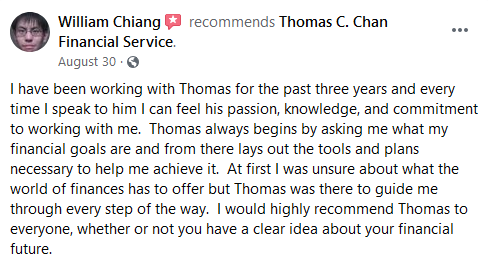

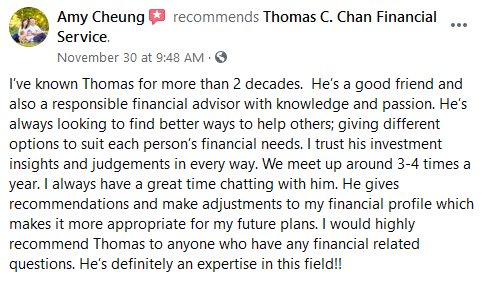

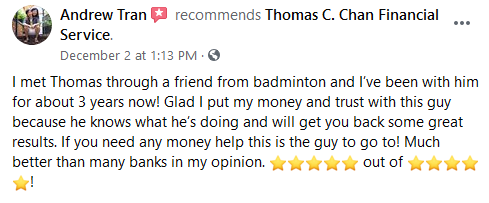

Most 5⭐️Reviews - Individual Advisor in B.C.

Increase Confidence

Be Empowered

Achieve Freedom

Canadians live paycheque to paycheque.

of Canadians have less than 3 months savings.

of Canadians could come up with $2000 in emergency money if needed.

Have comfort knowing you made educated decisions

I empower you with knowledge to make better choices to achieve your dreams.

Insurance Planning

Knowing how to protect is as important as knowing how to grow. I will show you how you can use insurance to protect you and your money from the tax man when your world is upside down.

Retirement Planning

Knowing your money will outlive you will give you peace of mind. I will show you what you need to do to have a vibrant and abundant retirement.

Wealth Planning

Get clear on what you need to do to get ahead. Learn the steps to get you closer to that house, car or vacation property!

Where to start?

Learn your starting point

Book a time to chat to see if we are a good fit. I will share tools and strategies with you to start you on your journey.

Create and Take Action

We'll create a plan based on your specific needs. I'll show you how to achieve them and take you through it step by step.

Refine and Monitor

I monitor the changes in the marketplace and your life. I touch base consistently to make sure the plan is on the right track and adjust if needed.

I know what it's like to fear money.

I know it's scary to talk about money.

I know what it's like to feel lost.

Let me share my story with you and share why I'm passionate about empowering you.

Why me?

| Constant Improvement | ✔ | ✔ | ✔ | ✔ | ✖ |

| High Compliance | ✔ | ✔ | ✔ | ✔ | ✖ |

| Personalized plans | ✔ | ✔ | Limited | ✔ | ✖ |

| Step-by-Step Consultation | ✔ | ✔ | Limited | ✔ | ✖ |

| Guaranteed Acceptance | ✔ | Limited | Limited | Limited | ✔ |

| Regular Scheduled Review | Semi-Annually | Annually | ✖ | Annually | ✖ |

| Team Approach | ✔ | ✖ | Limited | Limited | ✖ |

| Choice Of Providers & Plans | ✔ | ✔ | ✖ | ✖ | ✖ |

| Solution-Based Approach | ✔ | ✔ | ✖ | ✖ | ✖ |

| Instant Quote | ✖ | ✖ | ✔ | ✖ | ✔ |

| Comprehensive Planning | ✔ | ✖ | Limited | ✖ | ✖ |

| Education Channel | ✔ | ✖ | ✖ | ✖ | ✖ |

| One-Stop Network | ✔ | ✖ | ✖ | ✖ | ✖ |

My 3 Step Process

BOOK APPOINTMENT

About Insurance Planning and protecting your family when things don't go as planned.

LET'S DISCUSS

Let's chat about your retirement plans are. Where are you now and what you need to go.

About Me

Throughout my years within the industry, I have built a reputation for developing personal financial strategies, setting up risk management, and accumulating wealth for young individuals and families. Starting from friends and becoming extended family members, there is nothing more satisfying than witnessing people accomplishing their financial goals.

I want to focus on helping Canadians to make the right financial decisions. No matter what age group or background you are in, knowledge has the potential to unlock wealth.

The more you know, the better you become!

Everything You Need To Know About F.I.R.E Movement

Have you heard about the trendy retirement movement called FIRE? It is based on the attractive idea of retiring early, but what does it really stand for? Does it actually help you retire earlier? In this blog post, I’ll share everything you need to know about F.I.R.E so you can decide for yourself if you’re …

Everything You Need To Know About F.I.R.E Movement Read More »

Will & Estate Planning Checklist for Canadians

Have you ever wondered what happens to your assets when you get sick or pass away in Canada? You may also be wondering how long does it take to dispute assets from a deceased person or what do you need in order to control who gets what from the estate? In this blog post, I …

5 Key Steps in Retirement Planning

Retirement is inevitable and will come sooner than you think! This is why planning is key and in this blog post, I’ll be sharing 5 simple steps to plan for your retirement. Not just any retirement, a comfortable one, using vehicles that will help you save and strategies to utilize that will supplement your retirement …