Get Wealth Solutions and Life Insurance in Vancouver for a secure financial future.

Secure Your Future with Personalized Solutions - Start Now!

Retirement Benefits | Life Insurance Toronto

Discover Why Hundreds of Families in Vancouver Chooses Thomas C. Chan Financial Services

Expertise

Thomas has extensive 13-plus years of background in wealth and life insurance solutions.

Peace of Assurance

Get the most suitable policy that instill a sense of certainty in the financial security of your loved ones.

Reputation and Reliability

We are known for our honesty, openness, and trustworthiness as demonstrated by our reputable brand.

Tailored Attention

We operate in your best interest, prioritizing your needs with insurance providers and with wealth solutions, thus ensuring unbiased service delivery.

Comprehensive Approach

We assess all facets of your lifestyle and financial requisites to provide a holistic solution that safeguards your family's interests.

Accessibility and Communication

We are accessible and responsive to your inquiries. Clear and effective communication is essential throughout the process, from initial consultation to ongoing support.

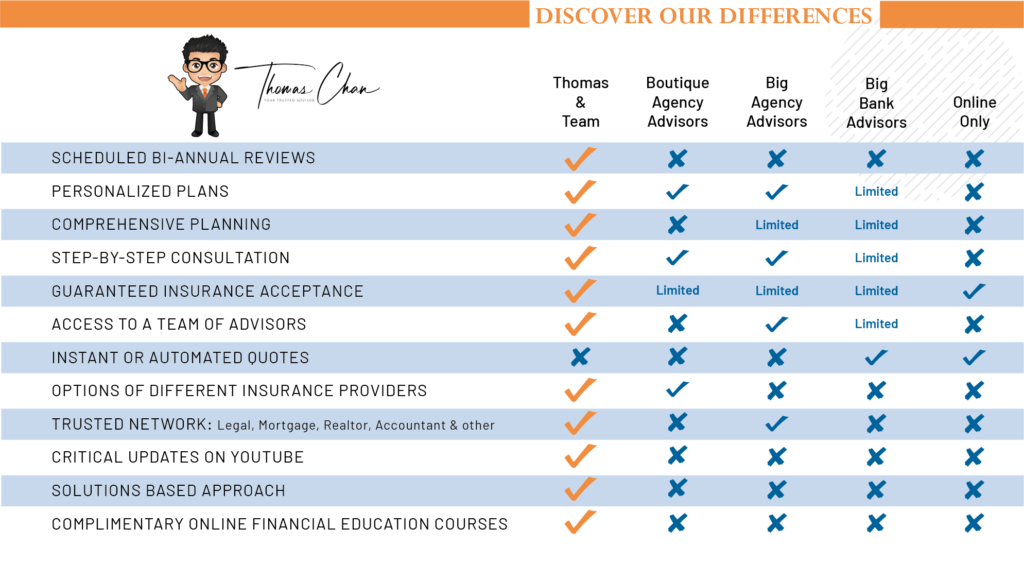

What Separates Thomas C. Chan Financial Services Apart

Unlock the Best Deals: Opt for an Insurance Broker!

Are you considering bypassing the intermediary and approaching insurance companies directly?

Let’s explore why collaborating with seasoned life insurance brokers from Thomas C. Chan Financial Services could offer distinct advantages.

By partnering with us, you gain access to tailored recommendations aligned with your unique requirements, expert guidance to navigate the intricacies of insurance policies, and dedicated support throughout the claims process.

Furthermore, our commitment to serving your best interests mitigates any concerns regarding conflicts of interest. Allow us to streamline your insurance experience with professionalism and expertise.

Our Top Insurance and Retirement Solutions

Term Life Insurance

Cost-effective term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, offering financial protection for loved ones in case of the policyholder's death. Unlike permanent life insurance, it does not accumulate cash value and is generally more affordable, making it a popular choice for those seeking temporary coverage.

Permanent Life Insurance

Permanent life insurance offers lifelong coverage and includes a cash value component that grows over time. It provides not only a death benefit but also an investment component, making it a long-term financial planning tool for policyholders.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder's life, as long as premiums are paid. It also accumulates cash value over time, offering a combination of lifelong protection and an investment component.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that allows policyholders to adjust their premiums and death benefits. It includes a cash value component that earns interest with various investment options, providing potential growth over time while still offering lifelong coverage.

Wealth Solutions

Discover the roadmap to a retirement free from worries, where financial strategies empower you to embrace your golden years with confidence and stability.

Business Succession Solutions

Insurance serves as a vital tool in business succession planning by providing liquidity to cover taxes, allowing for the seamless transfer of ownership while mitigating the impact of high taxation rates on investment income.

Client Testimonials of Thomas C. Chan Financial Services

Peggy Lei2022-11-12Thomas is always able to provide with the most valuable and suitable financial advices depending on my situation. I can always trust his judgement to making the most beneficial decisions for me.

Peggy Lei2022-11-12Thomas is always able to provide with the most valuable and suitable financial advices depending on my situation. I can always trust his judgement to making the most beneficial decisions for me. Aimei H2022-07-07Thomas is knowledgeable and provided great value on our call. If you need financial advice on how to best set you up long term, don't hesitate to set up a call with him.

Aimei H2022-07-07Thomas is knowledgeable and provided great value on our call. If you need financial advice on how to best set you up long term, don't hesitate to set up a call with him. Sally Jinjin Cheng2022-06-14I've worked with Thomas for the past 7 years, and each year is a positive experience. He is friendly, approachable, always reacheable, and personable. I can feel that he puts my interest first at all times. I feel my financial wellbeing is been very taken care of!

Sally Jinjin Cheng2022-06-14I've worked with Thomas for the past 7 years, and each year is a positive experience. He is friendly, approachable, always reacheable, and personable. I can feel that he puts my interest first at all times. I feel my financial wellbeing is been very taken care of! Winnnimalist2022-06-14Thomas is very responsible, knowledgeable and trustworthy~ All I need to do is to share with him my ideal financial goals and he will make it happen~~

Winnnimalist2022-06-14Thomas is very responsible, knowledgeable and trustworthy~ All I need to do is to share with him my ideal financial goals and he will make it happen~~ Mitchel D'Souza2022-04-26I set up an appointment with Thomas after seeing his YouTube videos. His concepts were crisp and clear and he has a very pleasant demeanor. I was pleasantly surprised to see that Thomas showed up himself for the free appointment. He helped provide an important tip to grow my portfolio. Thank you Thomas and i hope to work with you in the future.Google rating score: 5.0 of 5, based on 5 reviews

Mitchel D'Souza2022-04-26I set up an appointment with Thomas after seeing his YouTube videos. His concepts were crisp and clear and he has a very pleasant demeanor. I was pleasantly surprised to see that Thomas showed up himself for the free appointment. He helped provide an important tip to grow my portfolio. Thank you Thomas and i hope to work with you in the future.Google rating score: 5.0 of 5, based on 5 reviews

Vancouver Life Insurance FAQs

Secure Your Family's Future with Vancouver's Premier Life Insurance Solutions

Get the very best with top-tier life insurance options in Vancouver through Thomas C. Chan Financial Services. With a focus on individualized care, we’re here to fortify your family’s financial well-being.

Tackling the economic challenges of Vancouver head-on, we craft unique life insurance strategies for total coverage. Our expertise simplifies the intricate world of life insurance, ensuring comprehensive protection for those you hold dear.

Discover unparalleled service from Vancouver’s esteemed life insurance specialist.

Choose From the Best Life Insurance Companies